alameda county property tax payment

Pay Now Frequently Asked Questions Answers to the most frequently asked questions about property taxes. Alameda County Assessors Office 1221 Oak Street Room 145 Oakland CA 94612.

Understanding California S Property Taxes

Ad Tax Records for Alameda County Properties Have Been Digitized.

. Call your lender and Get Set up on an Impound Account. Winton Ave Room 169 Hayward. 125 12th Street Suite 320 Oakland CA 94607.

You can go online to the website of the county government and look up your property taxes. Look Up an Address in Alameda County Today. You can even pay your property taxes right from the app.

Assessed value exemption and tax payment. Office hours location and directions. Use a service like Easy Smart Pay.

Apply for Medicaid Online. The Alameda County Treasurer-Tax Collector Continues to Encourage Online Payment for 2020-2021 Property Taxes. Levy released publicly Monday the policies and procedures by which his office will be processing requests to waive penalties and interest related to delinquent property tax payments caused by the COVID-19 crisis.

More Information Business License Tax. Learn all about Alameda County real estate tax. The Assessment Appeals Board is located at the County Administration Building Room 536 1221 Oak Street Oakland California 94612-1449 Telephone 510 272-6352.

Whether you are already a resident or just considering moving to Alameda County to live or invest in real estate estimate local property tax rates and learn how real estate tax works. 125 12th Street Suite 320 Oakland CA 94607. Alameda County Assessors Office 1221 Oak Street Room 145 Oakland CA 94612.

Ad Pay Your County of Alameda Bill Online with doxo. The following information and services can be accessed with any touch-tone telephone 24-hours a day seven days a week by calling 510 272-6800. The TTC office announced plans to work with taxpayers on an individual basis to address hardships caused by the coronavirus and the.

Alameda County Treasurer-Tax Collector Henry C. There are several ways to pay your property taxes in Alameda County. Alameda County Treasurer-Tax Collector Pay Your Property Tax Pay your secured supplemental or unsecured property tax.

125 12th Street Suite 320 Oakland CA 94607. Order a current secured property tax bill. The second installment of property taxes for the 2019-20 fiscal year was due last Friday April 10 but.

To start the online payment of our tax we go back to the step of viewing bills and click on the Pay Bill button. Apply for Unemployment Insurance Claim. Levy the Alameda County Treasurer-Tax Collector regarding the benefits of paying your Property Tax using the Alameda County E-Check System.

Search Unsecured Property Taxes. Press Release The Alameda County Treasurer-Tax Collector Announces Policies and Procedures for COVID-19 Related Delinquent Property Tax Penalty Interest Waiver. Press Release Property Tax Cash Payments Accepted by East West Bank.

Set up an account with your bank. The Alameda County Treasurer-Tax Collector is pleased to announce that the AC Property App is now available on Apple devices. Alameda County Property Taxes Payment With Credit Card If we are going to pay with the credit card option we will select the value fill in the terms acceptance box and click on the Continue To Pay Contact button.

Apply for Medical Marijuana ID Card. The TTC accepts payments online by mail or over the telephone. Other Methods To Pay Pay property tax by phone mail in person and wire transfer.

Once online you can pay through the site but be aware that a convenience fee of. We can immediately release liens andor boat holds when paying by credit card. Download it from the iTunes store.

You can lookup your assessed value property taxes and parcel map. E-check payments are the same as regular checks and will take thirty 30 days to release a lien. Request Full and Updated Property Records.

Alameda County taxpayers experiencing financial hardship during the coronavirus pandemic can apply for property tax relief under the Alameda County Treasurer-Tax Collectors TTC COVID-19 financial relief effort. Pay current year and supplemental secured and unsecured tax bill. A message from Henry C.

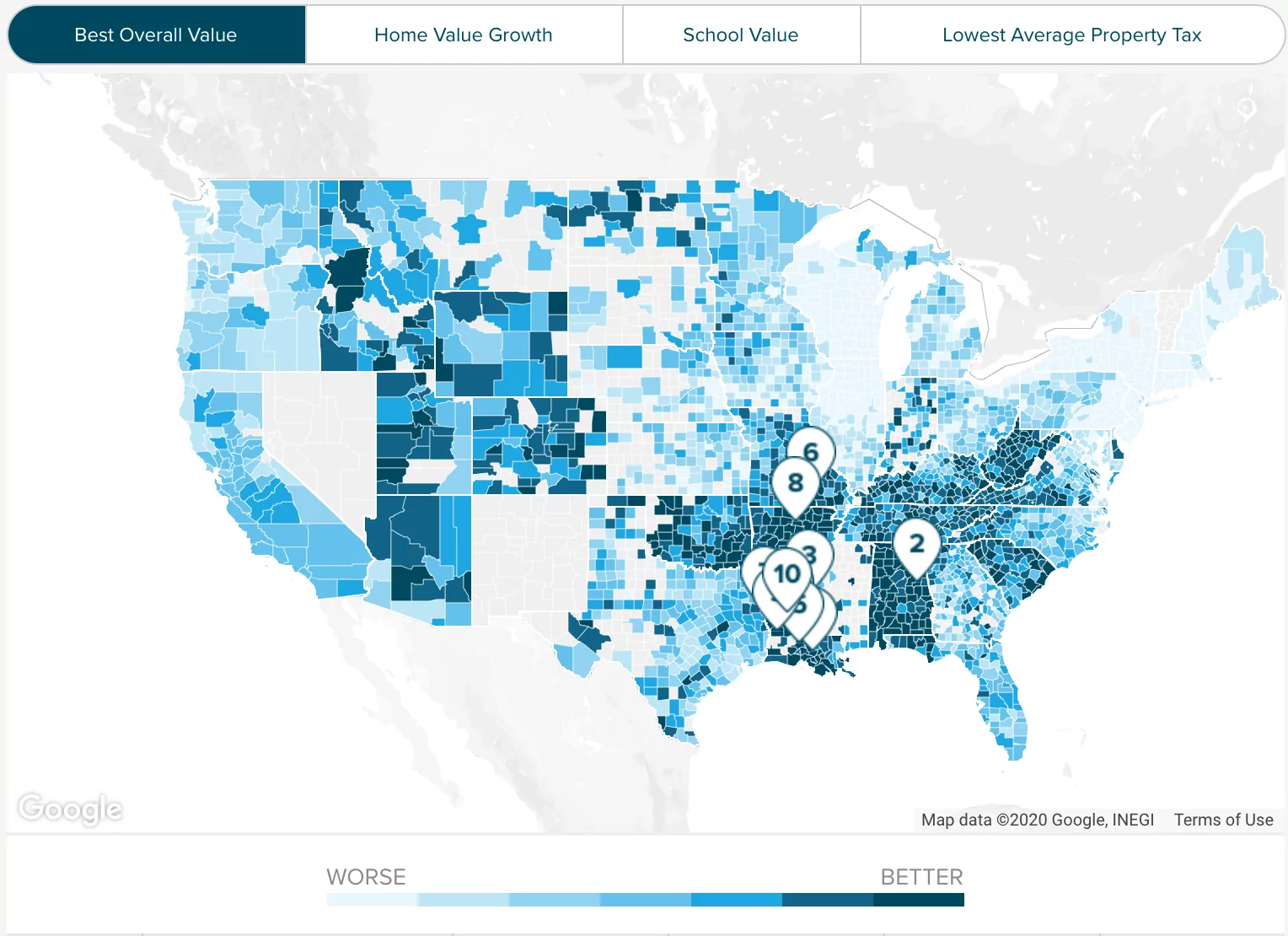

Look Up a Home Now. You can use the interactive map below to look up property tax data in Alameda County and beyond. Alameda County Assessors Office 1221 Oak Street Room 145 Oakland CA 94612.

FAQs Tax Defaulted Land Information about our public auctions including results. For more information visit our website at. To request immediate release please contact us at 510272-6800 Monday - Friday 830am - 430pm with your transaction number.

Search Unsecured Property Taxes. Last day to pay first installment of property taxes without penalty. You can place your check payment in the drop box located at the lobby of the County Administration building at 1221 Oak Street Oakland or through the mail slot at the Business License tax office at 224 W.

To ensure as assignment of valuation is not done by the Assessors Office submit your 571L by the April 1st deadline. How to change your mailing address.

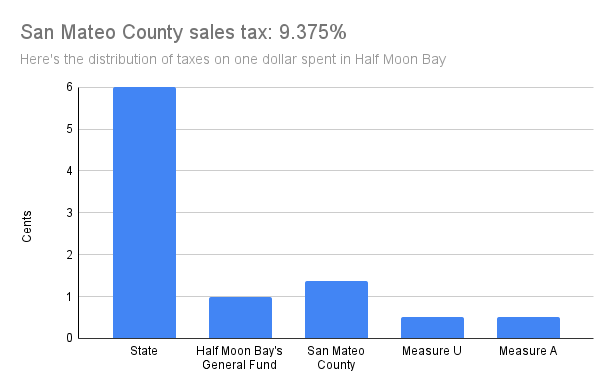

County Begins Collecting Higher Sales Tax Local News Stories Hmbreview Com

Transfer Tax Alameda County California Who Pays What

Alameda County Ca Property Tax Calculator Smartasset

New Program Allows Taxpayers Pay Annual Property Taxes In Monthly Installments County Of San Luis Obispo

How To Pay Property Tax Using The Alameda County E Check System Youtube

Monopoly Man Monopoly Man Music Business Alameda County

Pay Your Property Taxes Treasurer And Tax Collector

Home For Sale Flyer Selling House Real Estate Flyers Sale Flyer

Alameda County Property Tax News Announcements 11 08 21

Transfer Tax Alameda County California Who Pays What

Alameda County Ca Property Tax Calculator Smartasset

Alameda County Tax Collector Public Services Government 1221 Oak St Oakland Ca Phone Number Yelp

Treasurer Blog Treasurer Tax Collector Alameda County